California home prices fell year over year for first time in 2 years

Is the California Housing Market Cooling Off?

For the first time in nearly two years, California home prices have dropped year-over-year, according to recent data from the California Association of Realtors (CAR). This shift marks a critical moment for buyers, sellers, and investors alike — and at Fertig and Gordon, we’re here to break down what this means for your real estate strategy.

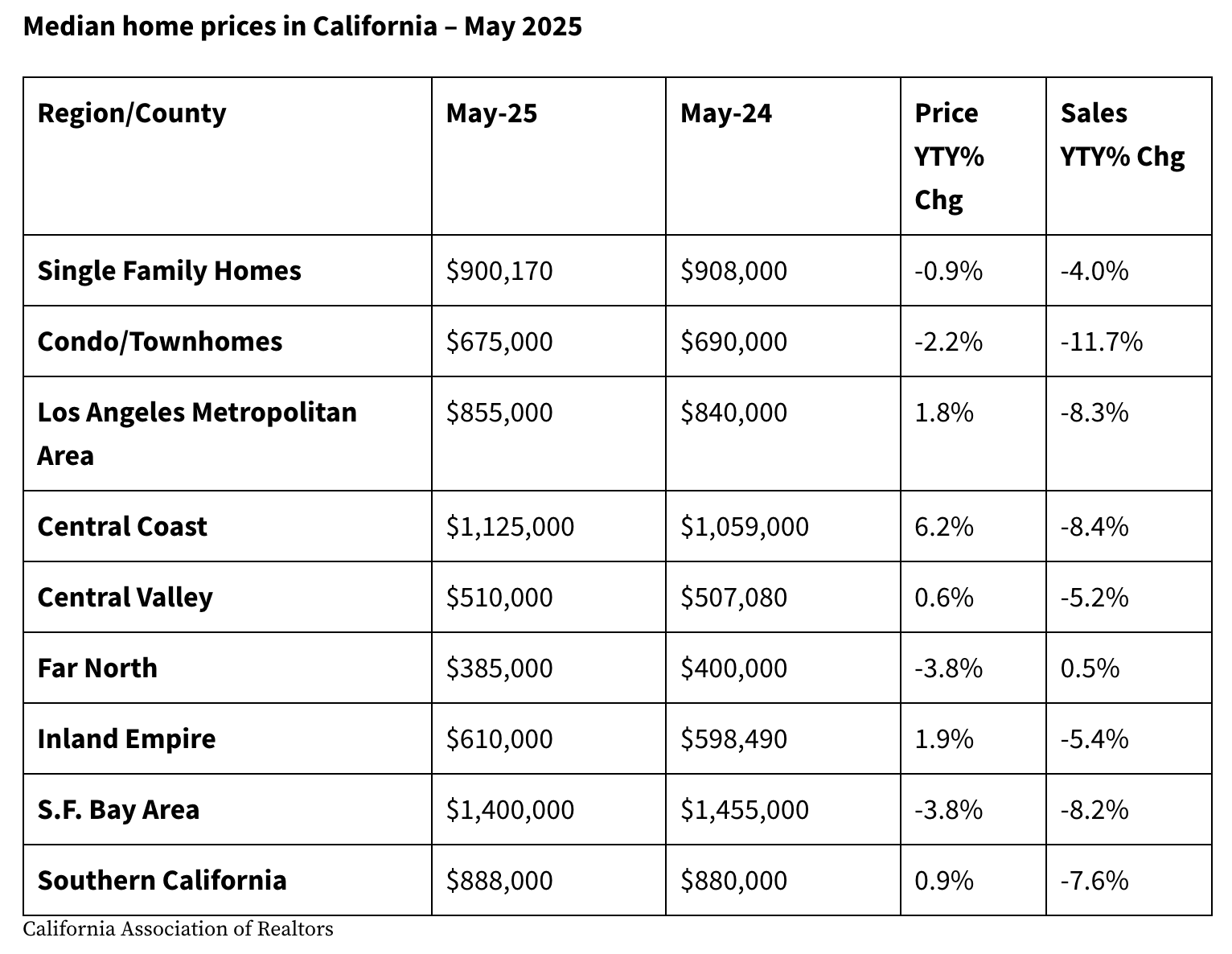

Median Home Prices Fall Statewide

In a surprising turn, the median home price in California dipped 0.7% year-over-year in September, landing at $843,340. While this may not seem dramatic, it represents the first annual price decline since early 2023, signaling potential momentum shifts in the market.

Local Impacts:

Some of California’s most active counties saw notable declines:

Santa Clara County: Down 5.2%

Santa Cruz County: Down 6.3%

San Mateo County: Down 10.3%

These areas, known for their high-demand and tech-driven economies, are often considered bellwethers for wider housing market trends.

Why Are California Home Prices Dropping?

At Fertig and Gordon, we track key housing indicators that influence property values. This recent dip is largely tied to:

Rising Mortgage Rates

With interest rates hovering near 8%, buyer demand has cooled dramatically. Higher monthly payments are pricing many out of the market — particularly first-time homebuyers.

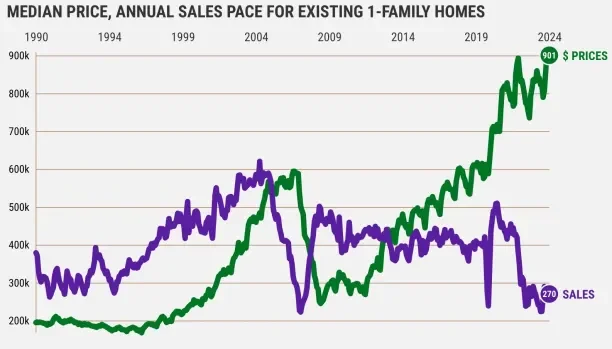

Declining Sales Activity

The CAR reports that home sales in California fell over 21% year-over-year in September. As fewer deals close, the days of frenzied bidding wars may be tapering off.

Increased Inventory in Select Markets

Although inventory remains tight overall, some regions have seen slight increases in supply, offering buyers more leverage.

What This Means for Real Estate Investors

If you're a real estate investor, developer, or landlord, this could be your moment. Here's how to capitalize on these trends:

1. Strategic Buying Opportunities

With prices softening in high-demand areas, investors may be able to acquire below-peak assets in markets with long-term upside.

Looking to identify undervalued opportunities? Schedule a consultation with Fertig and Gordon to get location-specific investment guidance.

2. Better Terms for Multi-Family and Rental Property Buyers

As residential prices flatten and sellers grow more flexible, buyers of multi-unit properties and investment rentals may find improved terms and better cap rate potential.

Our property management consulting services help you analyze ROI, structure deals, and reduce acquisition risk.

3. A Temporary Window for Landlords to Expand

While some landlords are holding, others are looking to expand their portfolio while competition eases. Acting now, before the market reaccelerates, could give you a significant edge.

Don’t Let Headlines Scare You — Let Them Guide You

While a dip in prices may trigger fear for some, smart investors know: market softening creates opportunity. Whether you’re looking to enter the market, expand your holdings, or rethink your strategy — now is the time to act with clarity and confidence.

At Fertig and Gordon, we work with:

Real estate investors and developers

Property management firms

Landlords building long-term portfolios

Buyers entering the California market strategically

Make Smarter Moves in a Shifting Market

This is the first real shift California’s real estate market has seen in nearly two years — and it won’t last forever. The window to buy smart, negotiate strong, and build equity is open.

Get expert insight from Fertig and Gordon — and turn market turbulence into long-term success.